Q4 PIMG Commentary: Cautious Optimism As We Enter 2025

The year 2024 was a strong one for equity markets and the fourth quarter was a positive contributor. Investors continued to enjoy the momentum developed in early 2023 that has carried equity markets for the better part of 24 months. The artificial intelligence (AI) theme and the hope of a more business-friendly political environment were meaningful narratives during the last quarter. Ironically, a healthy number of concerns that haven’t really disrupted economic output have provided the necessary skepticism for markets to continue to move higher. The proverbial “wall of worry” that is often cited, is indeed alive and well, and we enter 2025 much the same way as we did the last year, with cautious optimism.

It was all politics in the fourth quarter, as the U.S. election was front and centre. While we consistently preach political naivety, it was impossible not to consider the two candidates’ potential impact on markets. To note, the Biden/Harris administration actually provided a better four years for investors in U.S. markets than the previous four under the Trump administration, so perhaps anyone voting strictly for higher asset prices should have voted for Harris. That said, investors who have studied market history, or read our emails, would have understood that the party in power doesn’t actually matter too much in terms of market returns. Regardless of one’s political views, Trump’s upcoming second term promises to be eventful. For Canadian investors, we now have our own election to look forward to and the potential for a change of leadership. We also have the threat of tariffs and elevated uncertainty on a number of other policy initiatives. As mentioned on our recent podcast, the much larger concern for Canadian businesses should be the fact that Canada continues to become less competitive relative to its peer, the U.S. Higher taxes at every level, lack of capital investment outside of real estate and an extremely high regulatory burden continue to push both jobs and domestic and foreign investment south of the border.

On the more optimistic side of things, Canada now has the potential for change. We are hopeful that some of the missteps from the last decade can be corrected and Canada can regain its competitive position. If accurate, direct capital investment and the jobs that accompany it should return in conjunction with a pronounced economic upswing. The end result should be a resumption of leading GDP growth and a stronger Canadian dollar that has lagged within the G20. As Canadian investors, we have been looking for a reason to become optimistic about the Canadian economy and markets and, our view is a change of leadership could provide that catalyst.

Despite continued lackluster performance of the Canadian economy, Canadian markets performed well throughout 2024. December was mildly negative after a strong November and positive October. U.S. markets mirrored that performance. Perhaps the strangest part of 2024 was the relative calm that was exhibited throughout the year, as volatility was more or less absent. This was in stark contrast to the unrelenting headlines that were filled with concerns, warnings of recession, valuations arguments and political malaise. We experienced an almost 10 per cent correction in August but the equity market recovered what it had lost after a few days. Otherwise, investors that stayed invested and ignored the myriad risks were well rewarded as year- end statements will highlight.

The prominent theme of 2024 was undoubtedly artificial intelligence (AI). AI seemed to be on every investor’s mind and overwhelmed quarterly conference calls and market outlooks. Largely because of this, technology was again a standout performer, with much of this performance attributed to the biggest and most familiar names. Clients participated in this theme through names like Alphabet, Microsoft, Amazon, Apple and Shopify. All of these companies are spending billions of dollars to develop and integrate AI into as many channels of their business as possible.

However, not all boats rose in 2024. A theme that we keyed into throughout the year was the lowering of interest rates. Many companies that suffered considerably when interest rates started to rise in 2022, looked appealing to us as interest rates started to decline. However, many of these sectors, from real estate to utilities and telcos, continued to underperform despite rates heading lower. As famed investor Howard Mark’s said, “Being too far ahead of your time is indistinguishable from being wrong.” We remain optimistic that these unloved sectors will see positive momentum, as many of the headwinds throughout 2024 subside.

Another area that continued to be held back by interest rates was the bond market. Despite Canada lowering its key interest rates five times for a total reduction of 1.75 per cent, bond markets performed modestly. While a positive return was welcomed, after two of the last three years being negative, the low single- digit returns most aggregate bond indexes exhibited was not the recovery we would have expected, given the magnitude of the drop in rates. Despite central banks lowering short- term interest rates, longer- term rates failed to cooperate. This could be viewed as a healthy sign that term premium is returning; investors are being compensated for investing in longer- term maturities, as the yield curve un-inverts. Moreover, it could be the bond market telling us that this inflation story isn’t quite over yet.

During the quarter, we were somewhat cautious putting money to work, as valuations continued to give us pause. We did find opportunities to buy a few new companies including Shopify, Dell, and Verizon. Shopify continues to impress us with revenue growth rates above 20 per cent and earnings growth that is reflecting a maturing business. Dell is a familiar name on the hardware side with a lineup of personal computers. What’s not so well- known is that over half of their revenue comes from its “infrastructure solutions group.” This part of the business is serving the AI buildout and, last year, grew at over 34 per cent. The company still trades at less than 20X earnings, which is a much more comfortable level relative to some of the other companies involved in the AI buildout. Verizon is a company that has been performing well as a business, but whose stock has been punished by the market. Higher interest rates and slower growth lead to a more than 50 per cent decline in its share price. While higher rates make their debt structure more expensive to carry, we believe the moderation of rates and consistent cash flow should draw investors back to the name.

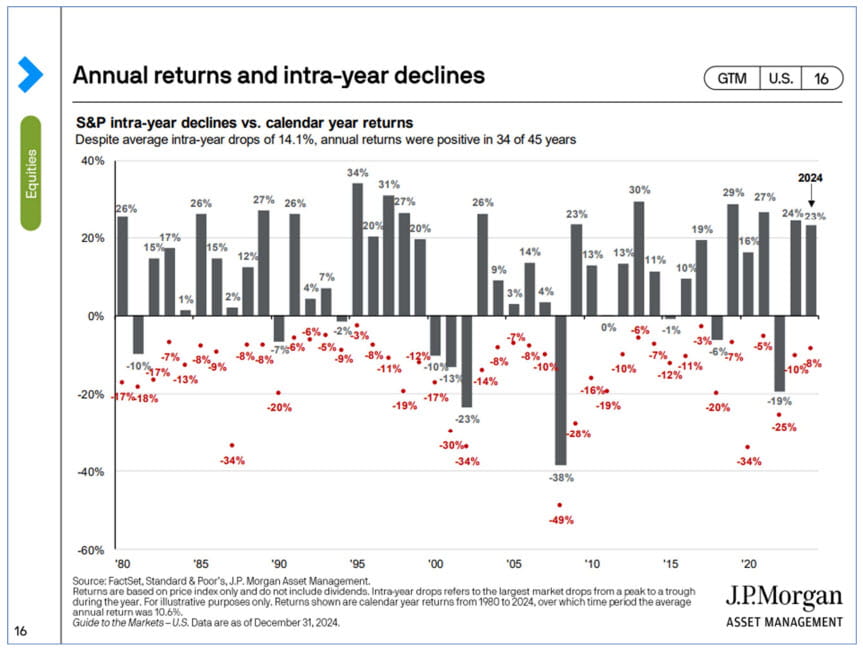

We continue to carry a somewhat elevated cash position across client mandates, as we head into the new year. Elevated valuations and mixed messages from interest rates, along with political uncertainty, give us pause in the near term. While markets typically produce positive returns following 20 per cent + positive calendar years, we can’t simply ignore the strong performance of equity markets since late 2022. In addition, investors have an overwhelming consensus view that 2025 will be a positive year. Of the 21 market strategists recently surveyed by Bloomberg, all 21 expect market growth this year with an average return of 12.3 per cent. Resounding bullishness such as this often forces us to challenge that consensus thinking and instead look through contrarian lens. In the end, there will certainly be a correction or pullback in 2025, as history shows that most years are susceptible to periods of weakness. In fact, despite average intra-year declines of 14.1 per cent, annual returns for equity markets were positive 34 out of 45 years, or 76 per cent of the time, as per the S&P 500 (Source: JP Morgan). Those are constructive probabilities for investors who carry a time frame that is measured in years as opposed to days, weeks or months. We feel clients are well positioned and our long-standing investment strategies are well-versed for what the New Year brings.

Your Plena Wealth Advisory Team

This newsletter has been prepared by Plena Wealth Advisors. Statistics and factual data and other information in this newsletter are from sources Raymond James (RJL) believes to be reliable but their accuracy cannot be guaranteed. This newsletter is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. RJL and its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. This newsletter is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. RJL is a member of the Canadian Investor Protection Fund.